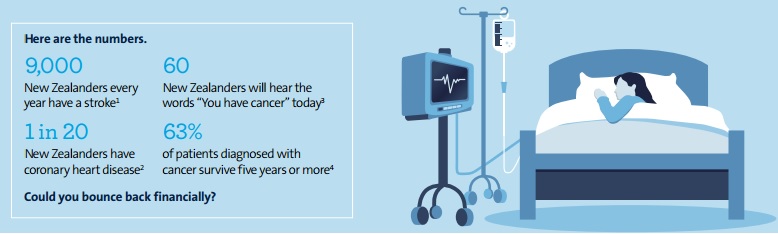

You’ve probably made a smart decision to protect those dearest to you with Life Insurance. But could you afford to pay the bills and medical fees if you were debilitated by a life threatening illness or injury? That’s why you need Trauma Cover. It provides you with a lump sum payment to use any way you like if you suffer a specified serious illness or injury, or undergo a serious medical procedure outlined in your policy. It’s completely up to you how to use the money – for example to help pay the mortgage, to cover medical expenses or to pay school fees. This helps you focus on treatment and recovery.

Want to discuss further? Talk to us today about your options for this important cover.