If you have EQCover, then some of your land is also covered. Land damage is considered separately from building damage.

If your home is damaged by a landslip you are generally insured by EQCover up to the maximum explained on the building cover page.

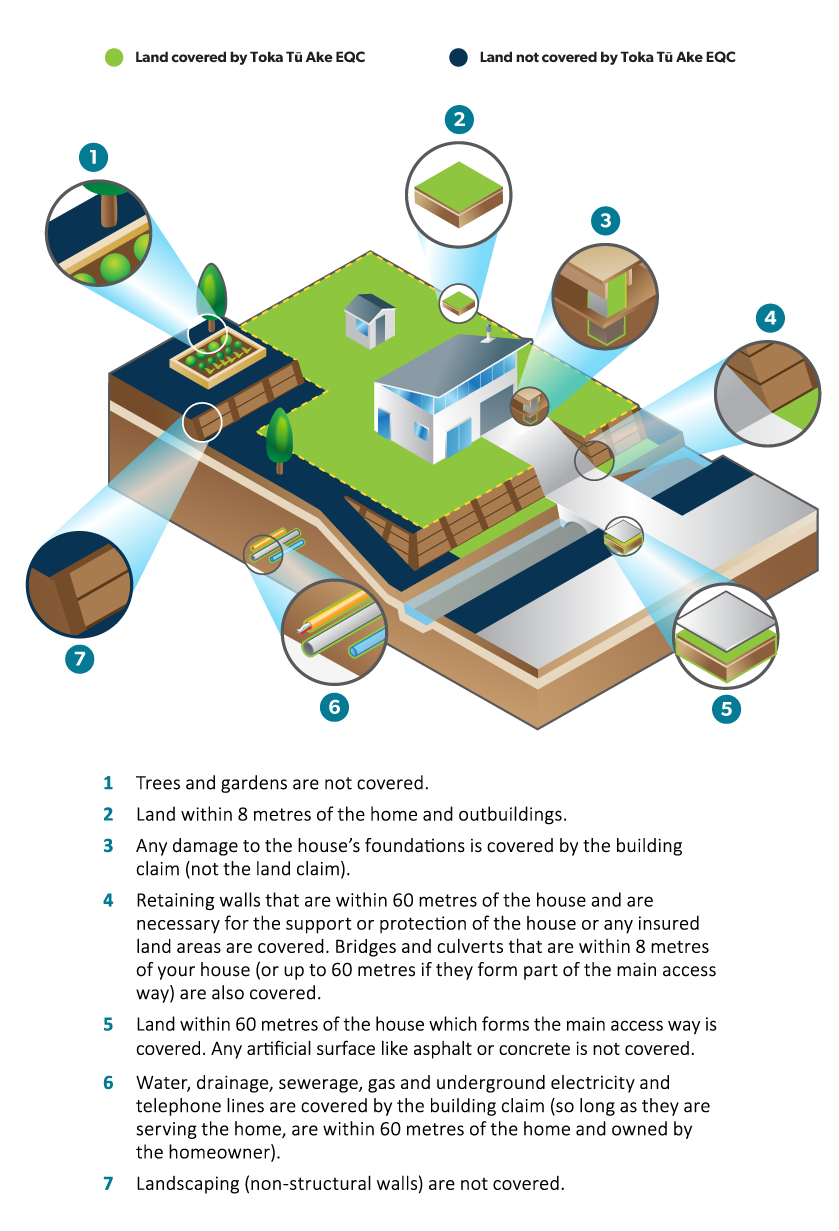

EQCover for land is limited to land that is within your property boundary – and includes:

the land under your home and outbuildings (e.g. shed or garage)

the land within eight metres of your home and outbuildings

the land under or supporting your main accessway, up to 60 metres from your home (but not the driveway surfacing).

EQCover also provides some cover for:

bridges and culverts within the above areas

some retaining walls that are necessary to support or protect the home, outbuildings or insured land.

Certain items on the land, such as trees, plants, lawn and driveways, aren’t covered. However, EQC do cover the removal of debris from your insured land, such as fallen trees.

landscaping

Certain items on the land, such as trees, plants, lawn and driveways, aren’t covered. However, we do cover the removal of debris from your insured land, such as fallen trees.

See the Householders' Guide to Residential Land to find out more.

EQCover land cap

Under the EQC Act, the maximum amount of EQCover for your residential land claim is capped at the land value, because EQCover cannot pay any more than what the damaged land is worth.

This is commonly referred to as the EQCover “land cap”, and is calculated in two parts:

the market value of the damaged or lost insured land (or other smaller specified area of land), and

the indemnity value of the damaged insured land structures (e.g. bridges, culverts and retaining walls).

More information, including how the market value is determined, is available in our Householders’ Guide to Residential Land.

We also have the following factsheets available:

Excess

The excess for a land claim is 10% of the amount payable for the land claim, but with:

a minimum of $500 for each home in the building situated on the land, and

a maximum of $5,000.

Private insurance cover

In general, private insurers don't cover land damage.

However, your private insurer may cover some items that aren’t covered by EQCover. For example, some private insurers offer limited cover for driveway resurfacing and repairs to landscaping or gardens.

Check your policy or contact your private insurance company for more information.

Source: EQC